‘Apple CEO Tim Cook made more money for Berkshire Hathaway than I ever did’: Warren Buffett | Top 10 quotes

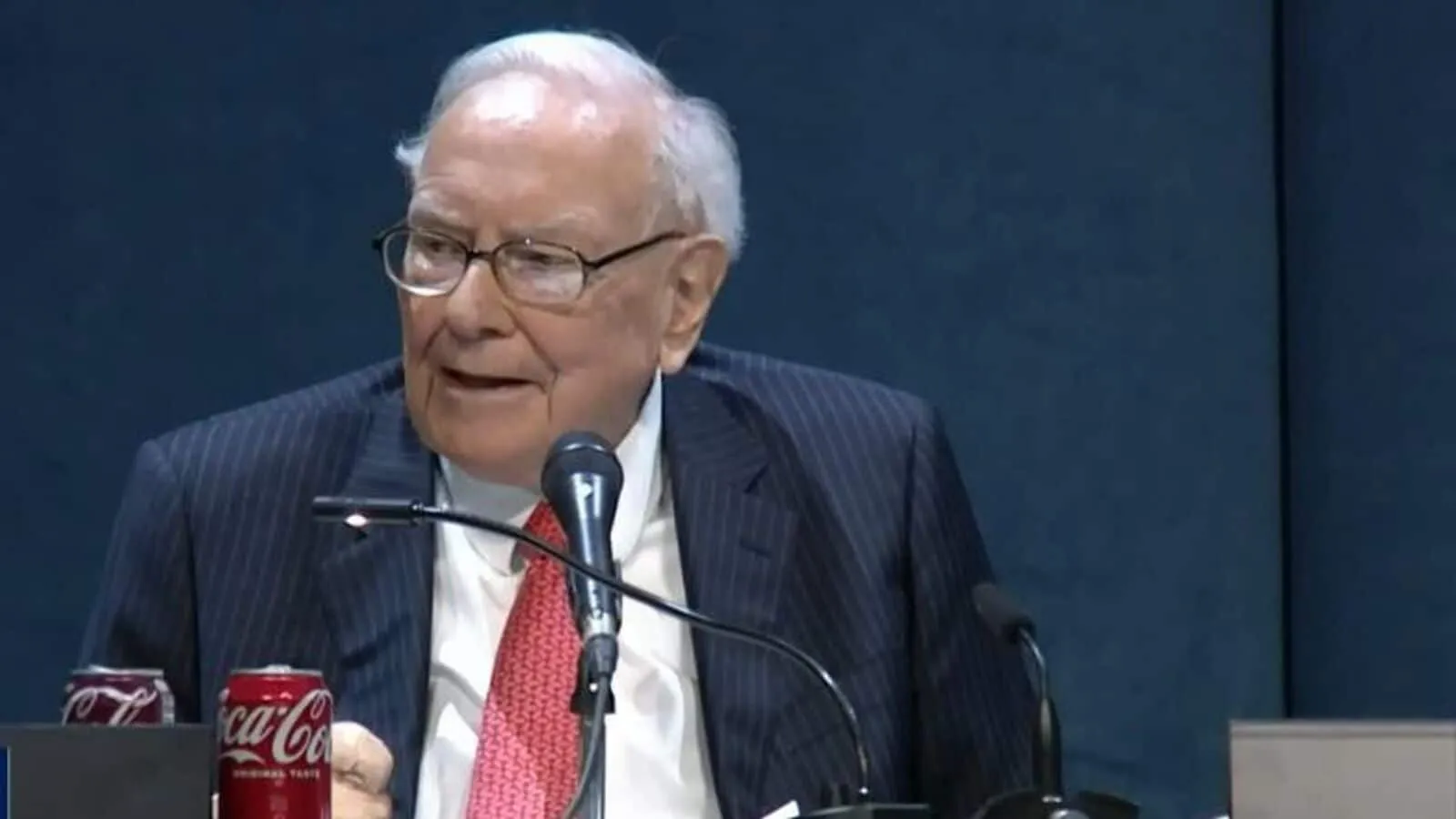

Berkshire Hathaway annual shareholder meeting 2025: Ace investor Warren Buffett presided over his 60th Berkshire Hathaway shareholder meeting on Saturday, May 3, and spoke on a range of topics, including trade policies and investment opportunities for the multinational conglomerate. Buffett was joined on stage by Berkshire’s top executives, Greg Abel and Ajit Jain.

The chairman and CEO of Berkshire Hathaway, also known as the ‘Oracle of Omaha,’ made the comments after the conglomerate posted a lower operating profit in the first quarter, dented by insurance losses from wildfires and foreign currency changes. Meanwhile, its cash stake grew to a record $347.7 billion.

Operating profit for the Omaha, Nebraska-based conglomerate dropped 14 per cent to $9.64 billion, or about $6,703 per Class A share, from $11.22 billion a year earlier. Net income was down 64 per cent to $4.6 billion, or $3,200 per Class A share, from $12.7 billion, reflecting unrealised losses on common stock holdings, including Apple. Let’s catch Buffett’s top 10 quotes from the annual meeting.

Warren Buffett’s top 10 quotes from Berkshire Hathaway’s annual meeting:

1.“Apple CEO Tim Cook made more money for Berkshire Hathaway than I ever did”

-Buffett initially took a lighthearted tone as he thanked Apple CEO Tim Cook. He said that following Apple’s latest earnings release, he tuned into Cook’s call on Thursday afternoon, the “only investment quarterly call” that he listened to. “I’m somewhat embarrassed to say that Tim Cook has made Berkshire a lot more money than I’ve ever made Berkshire Hathaway,” Buffett joked. “Credit should be given to him.”

2.“Trade should not be a weapon”

-Buffett criticised the idea of tariffs and trade protectionism, saying that “trade should not be a weapon. In the US, we should be looking to trade with the rest of the world. We should do what we do best, and they should do what they do best,” Buffett said. US President Donald Trump was not directly referenced.

“I don’t think it’s a good idea to design a world where a few countries say, ha ha ha, we’ve won,” Buffett added. “I do think that the more prosperous the rest of the world becomes … the more prosperous we’ll become.”

3.“The luckiest day of my life was being born in the US”

-Buffett seemed confident about US exceptionalism. “We’ve gone through great recessions, world wars, the development of an atomic bomb that we never dreamt of at the time I was born, so I would not get discouraged about the fact that it doesn’t look like we’ve solved every problem that’s come along,” he said

“If I were being born today, I would just keep negotiating in the womb until they said you can be in the US. We’re all pretty lucky,” he stressed. This is despite his criticisms of the current trade policy earlier in the session.”

4.“US stock market volatility in the last 30, 45 days is really nothing”

-“What has happened in the last 30, 45 days … is really nothing,” said Buffett, noting Berkshire Hathaway’s stock was cut in half three times during his 60 years running the company. Given that, he said the US stock market’s recent action should not be considered a “huge” move.

“This has not been a dramatic bear market or anything of the sort,” said Buffett. The S&P 500 nearly closed in a 20 per cent bear market at its low in April before Trump paused his tariffs on countries, causing a rebound. At the last check, the S&P 500 was down about eight per cent from its record high.

5.“A happy person lives longer…work at something you enjoy”

-When giving advice to a young investor, Buffett said that finding a way to be fulfilled and happy helps people have long lives. I think a happy person lives longer than somebody who’s doing some things they don’t really admire much in life,” Buffett said.

When answering a question about the plan for successor Greg Abel, Buffett gave advice about choosing a job and launching a career. “You really want to work at something you enjoy,” Buffett said during Saturday’s gathering.

6.“Real estate not the most interesting thing “

“In the US, there’s so much more opportunity that presents itself in the security market, than… in real estate. And in real estate you’re dealing with … usually … a single owner or a family that owns maybe a large property. They’ve had a long time, maybe they’ve borrowed too much … money against it.”

“Maybe the population trends are against them. But to them, it’s an enormous decision… For a guy of 94, it’s not the most interesting thing to get involved in something where the negotiations could take years,” said Buffett.